Home prices hit a record high in May despite falling demand and sales activity, The Wall Street Journal reported on Friday.

The national median home price in the United States is now $419,300, a 5.8% increase from a year earlier and a new record high, according to the The Wall Street Journal. The record high comes as homeowners remain unwilling to list due to high mortgage rates.

Housing demand has also been falling due to a lack of affordability – sales of previously owned homes decreased 0.7% month-over-month in May – but not at a fast enough rate to counteract limited housing inventory.

As a result, the American real estate market is experiencing “somewhat of a strange phenomenon, where we have low home-sales activity yet prices are hitting record highs,” said Lawrence Yun, NAR’s chief economist.

Rising prices, coupled with elevated mortgage rates, have made it harder for working class Americans to enter the real estate market.

In February 2020, shortly before the Covid pandemic, the median price of a home was $270,400 and the average 30-year-fixed-rate mortgage was 3.89%. The median price of a home now is $419,300, 1.55 times that amount, and the average 30-year-fixed-rate mortgage is 6.87%, more than 1.75 times the pre-pandemic rate, according to NAR data.

However, price gains could slow in upcoming months. Decreased affordability has driven consumer sentiment to a near-record low – just 14% of consumers surveyed by Fannie Mae last month believe now is a good time to buy a home, matching the record low from shortly after the 2008 financial crisis. As a result, homes have begun sitting on the market for longer as would-be buyers drop out of the market and wait for a more favorable rate environment, thus increasing inventories.

As the number of buyers has fallen, housing inventories have slowly begun to rise which should help alleviate housing prices, according to The Wall Street Journal.

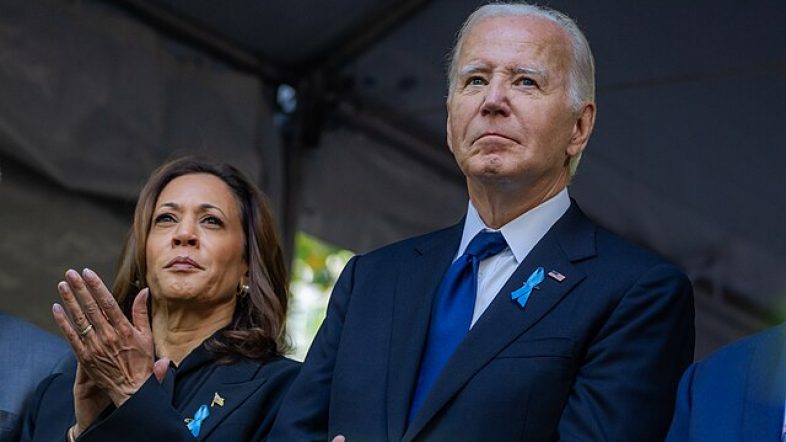

Since Biden took office in January 2021, inflation has risen 20.1% with annual inflation reaching as high as 9% in June 2022.. In an attempt to curb this Biden-era inflation, the Federal Reserve raised its federal funds rate from 0%-0.25% to 5.25%-5.5%, causing a surge in the cost of mortgages and other forms of borrowing for everyday Americans.