Americans are increasingly falling behind on their debt payments as inflation continues to erode real incomes, threatening to cause many consumers to declare bankruptcy.

Delinquency transitions, debts that were previously being paid but no longer are despite outstanding obligations, rose rapidly in the third quarter of 2023 in all forms of debt except for student loans, according to the Federal Reserve Bank of New York. Poor U.S. economic conditions linked to rising inflation and interest rates have left Americans unable to pay for previous obligations that they once could afford, according to experts who spoke to the Daily Caller News Foundation.

“Consumers pay for things three ways: income, savings and credit,” Michael Faulkender, chief economist and senior advisor for the Center for American Prosperity, told the DCNF. “We know that wages have not kept up with inflation over the last 2.5 years and that many households have spent all of the savings accumulated during the pandemic. Therefore, in order to maintain their spending levels, they have been adding to their credit card balances, such that aggregate balances have now eclipsed $1 trillion. Rising credit card debt in a rising interest rate environment with incomes not keeping pace will put more and more households into financial difficulty, resulting in delinquencies.”

Delinquency transitions for credit cards and auto loans saw the biggest increase among debt forms in the third quarter, rising to 8% and 7.4%, respectively, according to the New York Fed. Credit card debt increased to $1.08 trillion in the quarter, rising 4.7% from the second quarter, when it exceeded $1 trillion for the first time in U.S. history.

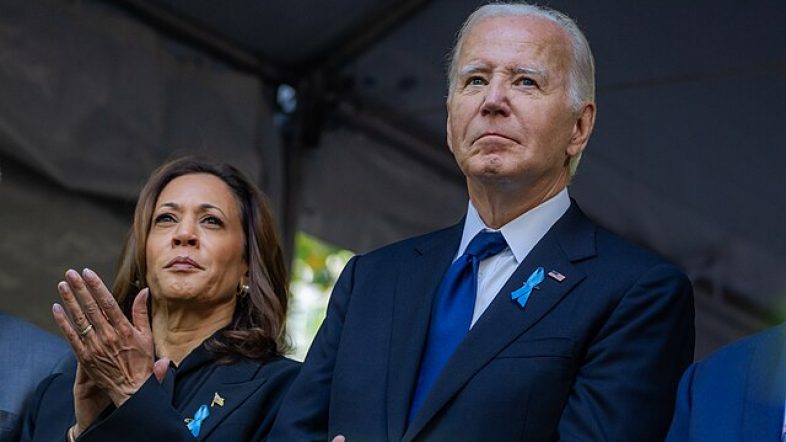

Real wages for average Americans have declined since President Joe Biden took office, sinking 2.1% from the first quarter of 2021 to the third quarter of 2023, according to the Federal Reserve Bank of St. Louis. Americans are increasingly turning to their savings to make up the difference in lost wages, with Americans collectively holding $687.7 billion in savings as of September 2023, compared to more than $1 trillion in May and nearly $6 trillion in April 2020.

“It likely indicates that average Americans are not doing well financially,” Jai Kedia, a research fellow for the Center for Monetary and Financial Alternatives at the Cato Institute, told the DCNF. “The quarter-by-quarter increase in delinquencies is probably a signal that the economy is not as good as people thought earlier this year — rather that the hard landing many predicted last year but never came may simply have been delayed.”

An economic soft landing refers to a slowdown in market growth that avoids a recession, as opposed to a hard landing, which would result in a recession, slowing economic growth but also ultimately bringing inflation down. Following the September Federal Open Market Committee meeting, Jerome Powell, chair of the Fed, said a soft landing was not a baseline expectation for the Fed in its fight against inflation.

“The rise in delinquencies is indicative of increasing strain on consumers,” Peter Earle, an economist at the American Institute for Economic Research, told the DCNF. “Over the past three-and-a-half years, we’ve had widespread unemployment, an uneven recovery, and then both the highest inflation and the most aggressive rate-hiking campaign in four decades. Inflation is still substantially elevated. Unemployment is rising faster now, the economy is slowing under the strain of higher borrowing costs, and bills are going unpaid.”

Inflation peaked under Biden at 9.1% in June 2022 but has decelerated since despite remaining elevated, measuring at 3.7% in both August and September, far from the Fed’s 2% target. In response, the Fed has raised its federal funds rate to a range of 5.25% and 5.50%, the highest point in 22 years, over the course of 11 rate hikes starting in March 2022.

“People respond to incentives,” Kedia told the DCNF. “The government provided massive amounts of fiscal stimulus that was marketed as a one-time gift. People used this windfall to purchase goods and services — perhaps these included down payments on durable items that are now getting difficult to pay back loans on.”

The Biden administration has pushed a number of big government spending bills, including the American Rescue Plan signed in March 2021 that provided $1.9 trillion in stimulus checks, debt bailouts and more. The president also signed the Inflation Reduction Act, which approved $750 billion in new spending, a large amount going to climate initiatives.

“In September 2023, for the fourth month in a row, real spending outpaced real income growth,” Earle told the DCNF. “This suggests that a large and growing portion of recent US spending has been drawn from savings and financed by borrowing. Although wages and salaries increased in September 2023, disposable income declined for the third consecutive month, signaling that American consumers have been saving less to support current and future spending. Not only does this mean that they are living beyond their means, but they are tremendously vulnerable to an unanticipated economic shock.”

The White House did not respond to a request for comment from the DCNF.