The U.S. House of Representatives pushed forward a new bill expanding tax credits for families, exposing a rift among conservatives over whether to back a pro-family policy or oppose the bill as a costly expansion of the welfare state.

The House passed a bill on Wednesday with bipartisan support that reforms and expands the Child Tax Credit until 2025 after it had previously expired in 2022. The debate over the child tax credit exposes differing opinions among conservatives over family policy, with some seeking tighter restrictions on tax breaks for families to ensure people remain in the workforce, while others are willing to take the risk of people not working if it means supporting families.

“For the last three years, American families, farmers, workers, and small businesses have borne the brunt of inflation as they watched their paychecks shrink and their purchasing power diminish,” Republican Rep. Jason Smith of Missouri, the chairman of the House Ways and Means Committee, said in a press release about the bill. “Under the Tax Relief for American Families and Workers Act, small businesses will benefit from pro-growth policies that will help them expand, build new facilities, and hire new employees at higher wages.

The bill expands on the current child tax credit, which, due to income requirements, leaves many low-income families without receiving benefits, according to CNN. Families would also get the option to base their tax credit on the previous year’s income, meaning if someone made more in the year before, they would be eligible for a larger benefit.

Some opponents of the bill point to data compiled by the American Enterprise Institute (AEI) claiming that 700,000 parents could stop working due to the bill’s allowance to qualify using income from the previous year, meaning if a parent met the income threshold in one year, they would receive the funds for both years. In contrast, the incentives built in for increasing a family’s income to earn a bigger tax break would only incentivize 395,000 parents to start working.

“The Child Tax Credit, as it currently exists, promotes employment because you only get it if you work,” Kevin Corinth, senior fellow at AEI and one of the authors of the study, told the DCNF. “The Wyden-Smith bill would change the credit’s work incentives in various ways. The one-year lookback would on net discourage work because you can maintain the credit next year without working, assuming you worked this year. The per-child benefit provision would strengthen the incentive to participate in work, but it would weaken the incentive to move from part-time to full-time work.”

Jonathan Ingram, Vice President of Policy and Research at the Foundation for Government Accountability, told the DCNF that the new Child Tax Credit will ultimately disincentive work and incentivize fraud and dependency for families.

Ingram uses the example of a family of three, with a single mom and two kids, making $23,833 under the current credit and receiving $3,200, according to calculations given to the DCNF. Under the House’s proposal, the mom would only need to make $13,167 to get that same credit, disincentivizing work.

“The Child Tax Credit as it currently exists is an effective way to reduce taxes for families,” Corinth told the DCNF. “There is always a tradeoff between targeting resources to families with lower incomes and incentivizing work. There’s also the question of the cost, since any additional benefits need to be paid by taxpayers at some point. Policymakers need to make these tradeoffs based on accurate information about the employment effects and budgetary costs.”

Duncan Braid, coalition director at American Compass, disagrees that lowering the income requirements to the proposed degree will hurt incentives as long as there is still an income requirement. He points to the unlikeliness that nearly three-quarters of a million people will choose to give up their income for a year just because they can receive a tax credit.

“Think about the struggles of a single parent earning $40,000 a year,” Braid told the DCNF. “Are they going to be able to forego that income? Maybe a single person in America might make this choice, but 700,000 people will bounce in and out of the workforce because of this change in the credit? It just doesn’t pass the smell test.”

Tax benefits targeted toward families receive large support from conservatives due to their reduction in taxes and encouragement of family values, but where conservatives differ is what requirements are needed to ensure that they do not expand the welfare state and discourage Americans from working. Some Republicans, like Utah Sen. Mitt Romney, also object to the expansion of entitlement programs without a solid way to pay for them due to the country’s massive deficit and debt, according to CNN.

“We support a benefit tied to work, and we have experienced previous iterations like the Great Society welfare programs that did encourage idleness,” Braid told the DNCF. “Those programs clearly did encourage people to leave the workforce or not go into the workforce and not get married. And this is why tying this provision to prior-year income is so important. Because it will encourage people to work, and that’s kind of the key difference between the assertions that this is going to expand the welfare state.”

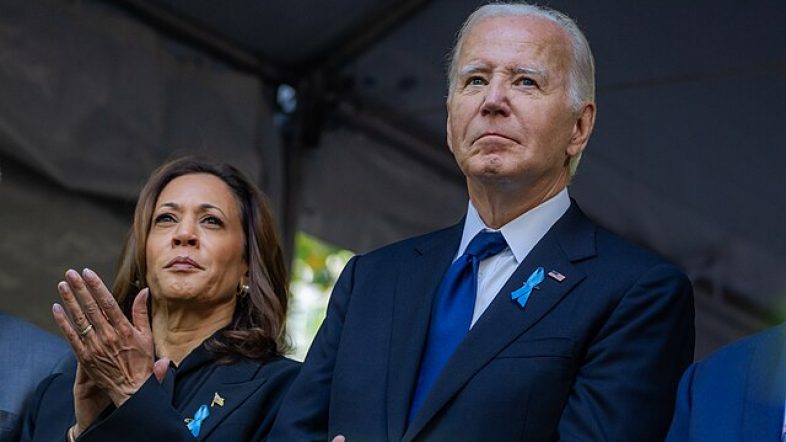

Some, including the Biden administration, have attributed the substantial rise in child poverty to the lapse in the tax credits created during the COVID-19 pandemic. The government’s supplemental poverty measure found that from 2021 to 2022, the number of children in poverty increased from 5.2% to 12.4%, while overall poverty rose 4.6 percentage points to 12.4%.

“We’re not at all happy about the rather expensive further expansion of the child tax credit, which…by the way…wouldn’t rule out tax credits basically going to children of illegal aliens,” Republican Chip Roy of Texas said in late January. “It’s a real problem that we’re concerned about given the current dynamic and what’s going on at the border.”

Will Kessler on February 4, 2024