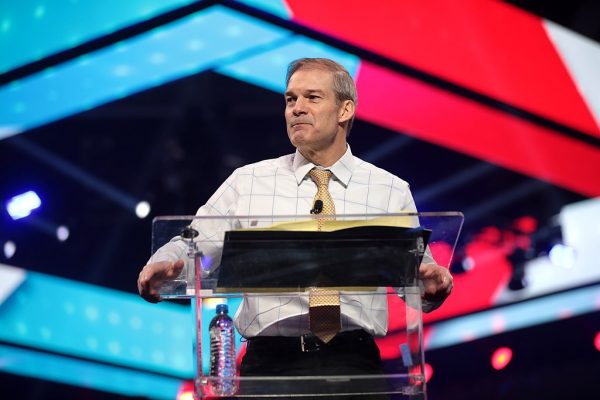

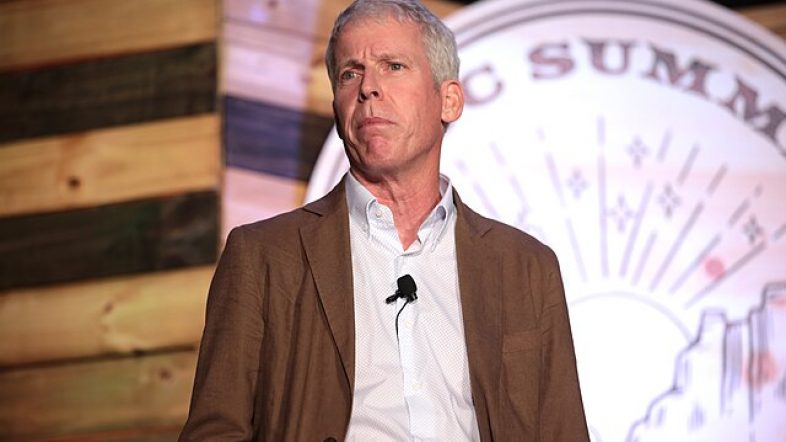

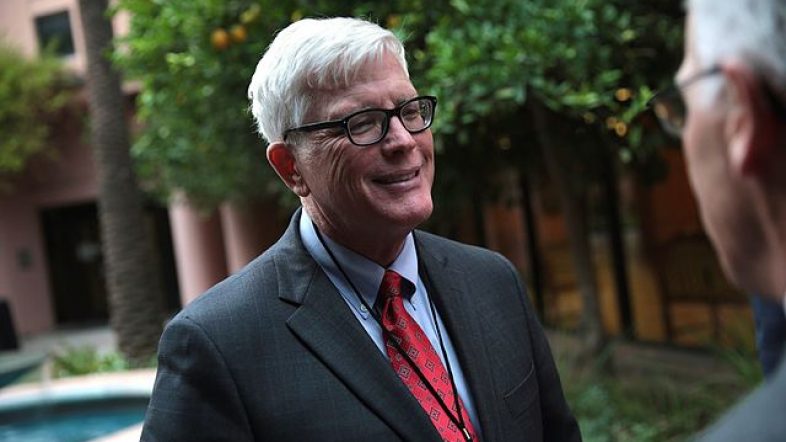

Chairman of the House Judiciary Committee, Representative Jim Jordan, and fellow Republican representatives, Dan Bishop of North Carolina and Thomas Massie of Kentucky, have issued a series of letters to some of the largest corporate entities globally, including BlackRock and Vanguard. These correspondences, initially disclosed to the Daily Caller, seek to scrutinize the companies’ environmental, social, and governance (ESG) endeavors, potentially infringing upon federal antitrust laws.

The representatives’ letters pointedly question the lawfulness of the corporations’ collaborative agreements to achieve ‘decarbonization’ of their managed assets and transition towards net-zero emissions. Their focus is primarily on the Glasgow Financial Alliance for Net Zero (GFANZ) and its sector-specific group, Net Zero Asset Managers (NZAM). GFANZ is a significant coalition of financial institutions dedicated to net-zero goals, while NZAM commands a notable $59 trillion in managed assets and a membership exceeding 300 asset managers.

The legislators’ concern extends to BlackRock, State Street, and Vanguard, ranking among the world’s leading asset managers. BlackRock and State Street have membership ties to both NZAM and Climate Action 100+. Vanguard was an NZAM member until December 2022. The lawmakers contend these companies may be conspiring to achieve net-zero emissions by 2050 or earlier across all managed assets.

This decarbonization push could inflict significant damage upon the coal, gas, and oil sectors, particularly as many seek to phase out gas-powered vehicles and coal and oil power plants. The representatives have expressed their concerns about the potential impacts of these initiatives on American freedoms and economic prosperity. In one of their letters, they assert, “BlackRock, Inc. (BlackRock) is potentially violating U.S. antitrust law by entering into agreements to ‘decarbonize’ its assets under management and reduce emissions to net zero—with potentially harmful effects on Americans’ freedom and economic well-being.” They have therefore requested BlackRock to provide pertinent documents and information, to facilitate oversight and potential legislative reforms.