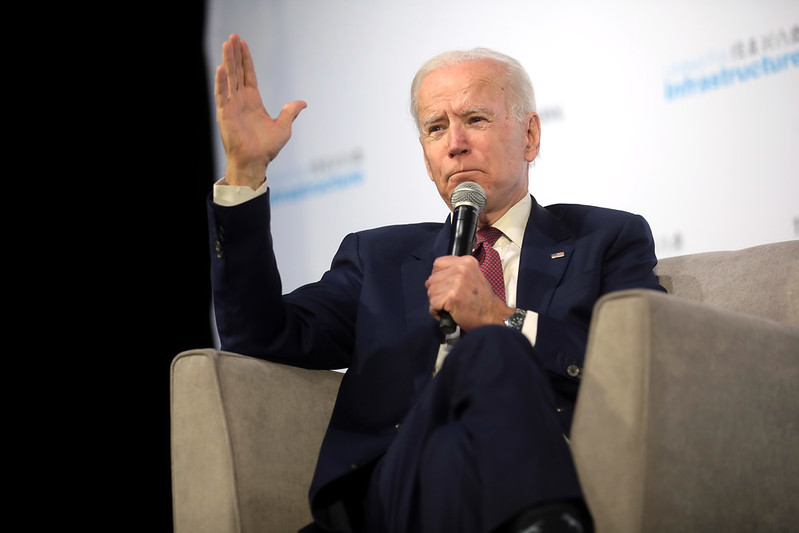

The Biden White House has repeatedly claimed that the administration has led the “greatest job recovery in American history,” but some economists are now throwing cold water on the claim. Recently Steven Pociask, an economist at The American Consumer Institute Center for Citizen Research, and Brian Riedl, a senior fellow focused in part on economic policy at the Manhattan Institute, spoke with The Daily Caller about these claims.

What Brian Riedl Said: Biran Riedl said, “Covid restrictions were lifted. That’s it!” while speaking with The Daily Caller.

Riedl added, “President Biden is taking credit for jobs that were going to come back either way regardless of any presidential policy, simply because the pandemic re-opened… He’s taking credit for the simple fact that the pandemic ended and people were called back to work, which was going to happen anyway.”

Riedl would flip the script on Biden’s claims by pointing out that the country has also never in history “lost 22 million jobs in one month, must less recover them two years later.”

What Steven Pociask Said: Steven Pociask would make a similar argument while speaking with The Daily Caller. Pociask would add that President Biden’s comments regarding job recovery were “half-true.”

Pociask would say, “They’re giving him credit for bringing everything back because of Covid… This is completely the result of covid, the downturn and the upturn.”

“The question we should be asking ourselves is what, if anything, he’s done in addition to that, and as I’m looking at the statistics today – and I can say now that everything opened up, the market is back opened up – why aren’t we at the same level that we were in February of 2020?”

Pociask would tell The Daily Caller, “It’s right there. It’s clear to me that… to account for the seasonality; there’s no other way to come to the conclusion that employment, labor force participation, and real hourly earnings is lower today than it was in the February before Covid. It’s as simple as that.”

The Details: The U.S. economy added 390,000 jobs in May, but the unemployment rate remained around 3.6%, according to the Bureau of Labor Statistics.

These claims from the Biden administration have been made numerous times. For example, when the November jobs report was released, President Biden announced that America was going “back to work.” In March, Politifact checked out Biden’s claims of his administration having created “more jobs in one year than ever before in the history of the United States of America.” Politifact rated the claim as “half-true,“ pointing out that while the administration had a point, they were missing the greater context of these numbers.

The Congressional Research Service found that the U.S. plummeted into a recession in March of 2020 due to the Covid-19 pandemic at a rate far worse than that of the Great Depression. The U.S. has since recovered from this, but another recession still looms.

What Comes Next: Destination Wealth Management’s Michael Yoshikami has recently warned that the U.S. is heading towards a recession in the third quarter. While appearing on CNBC’s Squawk Box Europe this past Thursday, Yoshikami said, “Now the problem we’re going to have here is are they going to tip the economy into a recession when the consumer is already starting to pull back?”

“The housing market in the U.S. is really locked up with mortgage rates close to 6% right now, and I think it’s a virtual certainty that we’re going to go into recession next quarter,” Yoshikami said. “There is a belief that if we raise [interest rates] enough – let’s say we raise by 75 and then we raise by another 75 – then if there is a problem in the economy if it’s a shallower recession, which I suspect it would be in the third quarter, the Fed actually has some room now to come back off of some of those rate increases.”

Yoshikami believes a recession is coming, but he is not alone in thinking this. Andrea Dicenso, the vice president of Loomis Sayles, recently came out to put the chances of a global recession around 75%.

Dicenso would add that “The Fed’s action yesterday, as well as the other coordinated central bank action, has led us to think that perhaps that global recession is likely to be shallow and potentially already prices into some assets.”

One investor currently pushing back on the idea of a recession is celebrity investor Kevin O’Leary. O’Leary recently said on CNBC that the U.S. economy is a lot stronger than people think and that there is “no evidence” of any impending slowdown or recession as of late. “I’m not saying we won’t get one, but everybody that’s saying it’s coming around the corner next week is just wrong,” O’Leary told CNBC’s Squawk Box Europe.