Millions of Americans are struggling to afford necessities like food, rent, insurance and a car payment. But if you’re one of them, don’t expect any understanding from the White House and its sycophants in the media. They say your financial pain is all in your head.

As an MSNBC host put it, Americans need “an economic explainer,” since “people are confused” about their financial situation. They’re actually “doing quite well,” she laughably asserted.

That will surprise the half of Americans who are struggling to make their rent or mortgage payments on time, especially the one-fifth of renters who are skipping meals to stay current, or the 65 percent of Americans who say their finances have deteriorated over the last year because of inflation.

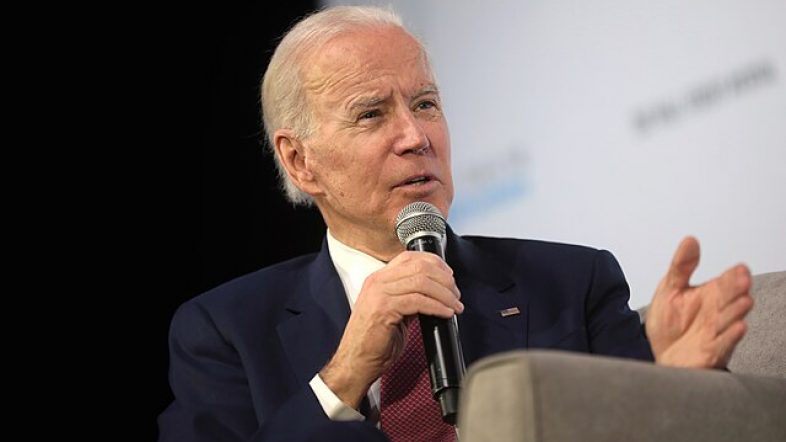

Similarly, when President Joe Biden was told by an interviewer that food prices are up 30 percent in four years, he blithely dismissed it. American families, he claimed, “have more money to spend.”

But that’s simply not true, and the Biden administration’s own data prove it. The average American worker’s weekly paycheck has risen about 14 percent under Biden, which is less than the 20 percent general inflation rate and even less than the 30 percent inflation rate for food, which is what Biden was asked about.

But the falsehoods don’t stop there. Both the president and his lead economic advisor, Jared Bernstein, have fallaciously claimed in multiple interviews that inflation was 9 percent when Biden took office. Again, the administration’s own data disprove this talking point.

Inflation was only 1.4 percent at Biden’s inauguration. When confronted with this fact, Bernstein retorted with another lie: that inflation, excluding food and energy prices, was at 9 percent in the second quarter of 2021.

Again, the Biden administration’s own data disproves this. The inflation Berstein referenced, “core” inflation, was 3.7 percent at that time. Furthermore, Biden didn’t take office in the second quarter of 2021, but in the start of the first quarter. At that time, even the core inflation rate which Bernstein referenced was 1.4 percent–the same as the overall inflation rate.

Not to be dissuaded by the facts, Bernstein then pivoted to excusing the inflation rate entirely, claiming people are better off because their earnings are now rising faster than prices. Apparently, Bernstein is completely unfamiliar with any statistics produced by his colleagues. In April—the most recent data available—prices rose faster than the average weekly paycheck.

What that weekly paycheck can actually buy has fallen 4.4 percent since Biden took office, costing the typical American family thousands of dollars annually in lost purchasing power. Add in the additional borrowing costs from today’s higher interest rates, and that is thousands more in financial pain.

The combined effect has been the equivalent of reducing the typical American family’s annual income by $8,100.

But it seems no figures or statistics can change the mind of the political elites when it comes to inflation and how much Americans are hurting today. Never mind that the price of common foodstuffs like eggs, bread, and peanut butter have risen 35 percent under Biden—the pain is all in your head.

The Biden administration’s and their media lapdogs’ dismissive attitude to the financial plight of the American people adds insult to injury. Nothing is more elitist than telling working-class folks that their problems are imaginary.

American families have soured on Bidenomics not because of rhetoric, but because of reality. The spendthrift policies of this administration and its congressional allies have created a cost-of-living crisis, which is why millions of Americans are demanding a change in direction.

Much like the average weekly paycheck, you might say the president’s poll numbers have been adjusted down for inflation.