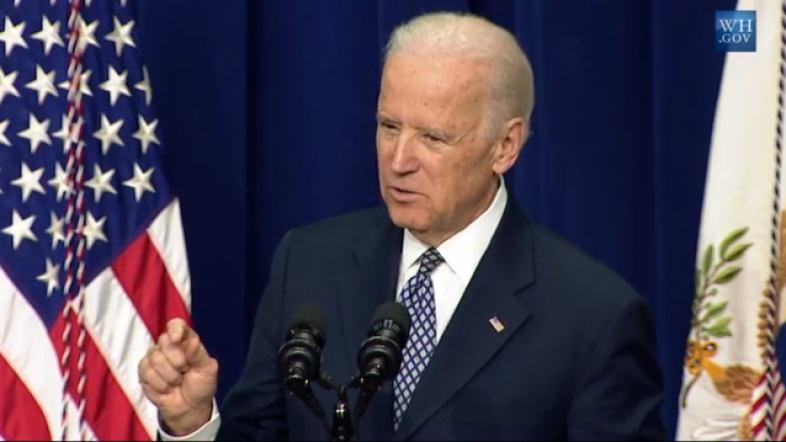

No issue defines the diametrically opposite economic philosophies of Joe Biden and Donald Trump more than their position on the Trump tax cuts.

Trump wants to make those tax cuts permanent; Biden has repeatedly promised to tax America back to prosperity by repealing the Tax Cuts and Jobs Act. But there are so many factual errors swirling around regarding the Trump tax cuts, that it’s a wonder that the “truth screeners” on the internet haven’t flagged this all as “disinformation.”

So, as a public service I will help do their job for them and review “just the facts, ma’am,” using the official government data on how after five years the tax cuts have impacted jobs, the economy, tax fairness, and the simplicity of the tax code.

1 — The Trump tax law was one of the biggest middle class tax cuts in U.S. history. The Trump Treasury Department calculated that the average family of four saves roughly $2,000 a year. This means, sorry Joe, repealing the bill would raise taxes for most families making less than $400,000. The House Budget Committee has estimated that the typical family will pay $1,500 more in taxes annually if Biden repeals the Trump tax cut.

2 — The Trump tax cuts vastly simplified the tax code for the majority of Americans. A major feature of the bill was to double the standard deduction from $12,500 to $25,000.

As a result, prior to the Trump tax cuts, about one-third of tax filers had to itemize their deductions and keep track for the IRS of shoe boxes of receipts and other transactions related to mortgage payments, charitable deductions, interest payments, and so on. Now, nearly 90% of Americans–and almost all middle- and lower-income families–just check a box of the standard deduction.

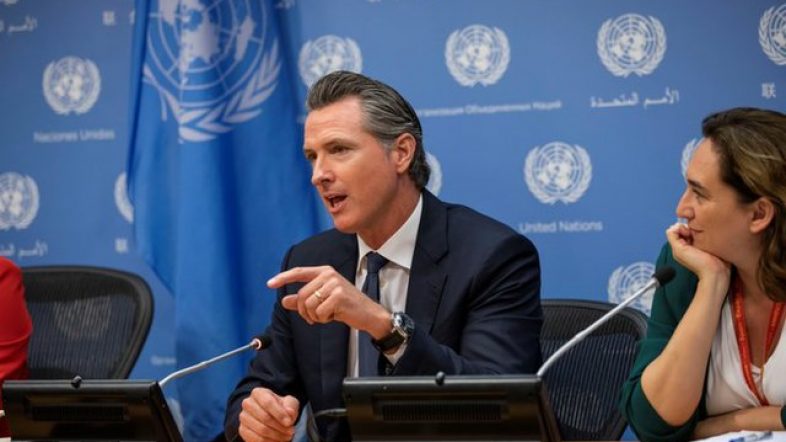

3 — The Trump tax bill forces millionaires and billionaires in blue states to pay their fair share of taxes. One of the smartest features of the Trump bill was to cap the deduction of state and local taxes for the super-rich.

This allowed millionaires and billionaires in blue states like New York and California to pay billions of dollars less taxes than an equally wealthy tax filer in low tax states like Florida and Texas. The old law encouraged states and localities to raise their taxes because it shifted the federal tax burden on to residents of other states.

4 — The Trump tax cut expanded the economy and business activity, which ended up RAISING tax revenues. A study by Heritage Foundation fiscal analyst Preston Brashers examined the impact of the Trump tax cuts after four years and found that the policy changes actually raised MORE revenue in its first four years than the Congressional Budget Office predicted without the tax cut.

The House Budget Committee similarly concluded in a May 2024 analysis that: “The Trump tax cuts resulted in economic growth that was a full percentage point above CBO’s forecast.” Revenues were $200 billion a year MORE than was predicted before the tax cuts.

5 — The rich paid more, not less taxes after the Trump tax cut. Joe Biden says continually that the major reason the deficit has exploded is that Trump cut taxes on the rich. Wrong.

Five years after the Trump tax cuts, the IRS’ own data show the top one percent of earners in America saw their percentage of total income taxes collected rise from 40% to 46% of the total in 2022. This was the largest share of taxes paid by the rich ever.

The truth is, almost all of the negative claims that Democrats made in opposing the Trump tax cuts in 2017 were proven to be fallacious. Rather than admit that they were wrong, they’ve doubled down in their commitment to policies that would raise taxes on virtually every American corporation, small business, family, and investor.

Perhaps the theme for the Biden campaign should be “Putting America Last.”